The hotel industry in Cyprus operates under a clearly defined set of employment regulations designed to protect workers and ensure fair labour practices across the sector. As we move into 2025, hotel employers must remain aware of several key legal obligations relating to minimum wages, provident fund participation, compensation for work on public holidays, and the mandatory 13th salary. Understanding these requirements is essential not only for compliance but also for maintaining transparent and equitable working conditions within the hospitality industry. This article outlines the most important provisions that hotels must follow and highlights the consequences of failing to meet these statutory duties.

Provident Fund for Hotels

(

Hotel Employees Provident Fund – HEPF / Ταμείο Προνοίας Ξενοδοχειακής Βιομηχανίας) As of

25/07/2025, participation in the Hotel Employees Provident Fund is

mandatory for hotels, subject to the applicable conditions of the Fund and collective agreements.

The contribution rates are as follows:

- Employer contribution:

- 5.00% until 31/12/2025

- 5.25% until 31/12/2026

- 5.50% from 01/01/2027 onwards

- Employee contribution:

- Either 5% or 10%, depending on the employee’s choice.

Payment for Work During Public Holidays

Employees who work on an official public holiday are entitled to one of the following:

- Payment of an additional 1.5 daily wages, on top of the normal daily wage; or

- Compensatory annual leave, as agreed.

For the following public holidays, compensation is

mandatory in cash only and calculated as

two (2) additional daily wages plus the normal daily wage:

- Christmas Day (25/12)

- New Year’s Day (01/01)

- Easter Sunday

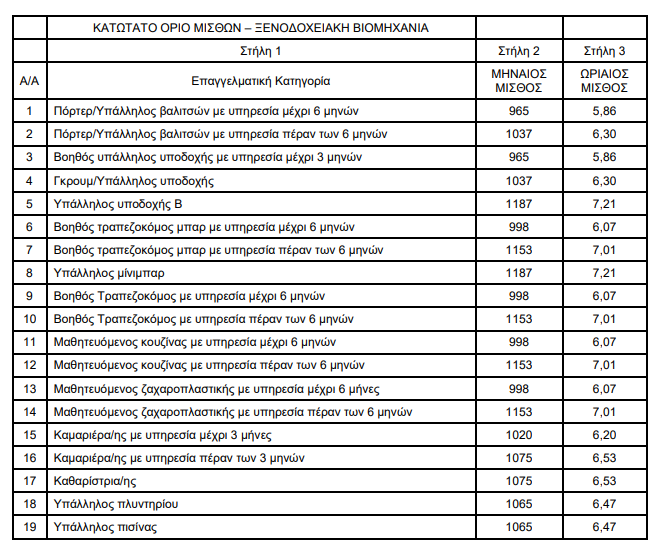

Minimum wage – Hotel Industry

Please refer to the table below, which outlines the

minimum monthly and corresponding hourly wages applicable to hotel employees by position, effective

01/01/2025.

13th Salary

13th Salary

The 13th salary is

mandatory for hotel employers and must be paid

no later than 20 December of each year.

- Employees who have worked for a full calendar year are entitled to one full additional monthly salary.

- Employees who have worked part of the year are entitled to the 13th salary on a pro-rata basis.

Any bonuses paid by the employer constitute an

additional benefit and

may not substitute the statutory 13th salary.

Finally, Hotels cannot legally avoid any of these obligations. Failing to comply risks financial penalties, legal action, and in severe cases, criminal liability for directors/managers.

For more information regarding the regulation, please follow the link provided

here in Greek.

For any other queries send your email at

info@cfa-auditors.com

Author: Alexandros Christodoulides